Remodeling Impact Report: Projects That Bring Joy & ROI

Is your home ready for a refresh? Whether it’s for their own enjoyment or to prep their houses for sale, Americans are investing more and more money into remodeling each year. According to a recent report by the National Association of REALTORS® (NAR), the demand for top-condition homes is going up among buyers as well. So which projects will get you the most bang for your buck? Or, perhaps more importantly, which projects will bring you the most joy? Here’s what the Remodeling Impact Report revealed…

Projects That Boost Your Happiness

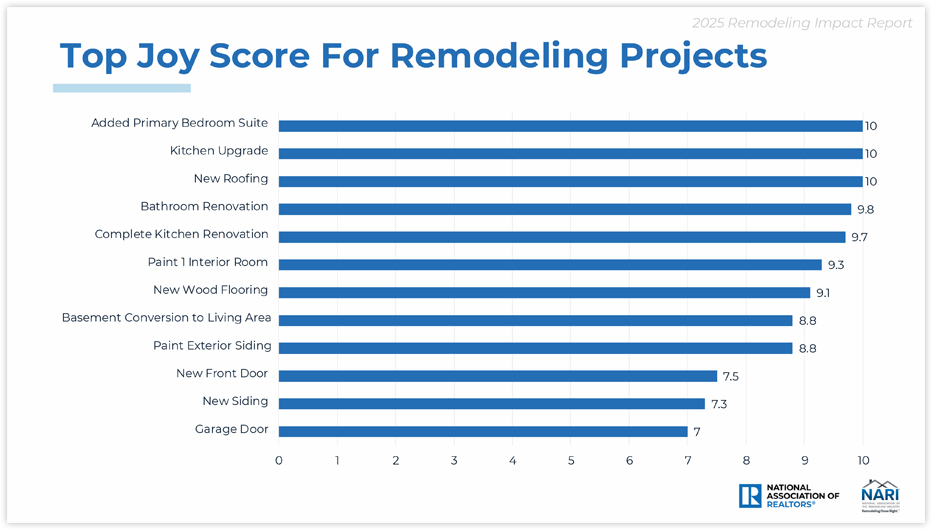

It’s easy to think about improvements in terms of monetary value…but what about the value of enjoyment and enhanced livability? As part of their report, NAR calculated a “Joy Score” for common remodeling projects based on the happiness homeowners reported with their renovations. Three projects stood out with perfect joy scores: adding a primary bedroom suite, upgrading the kitchen, and replacing roofing. Here are the projects with the highest joy scores:

Projects That Help Pay for Themselves

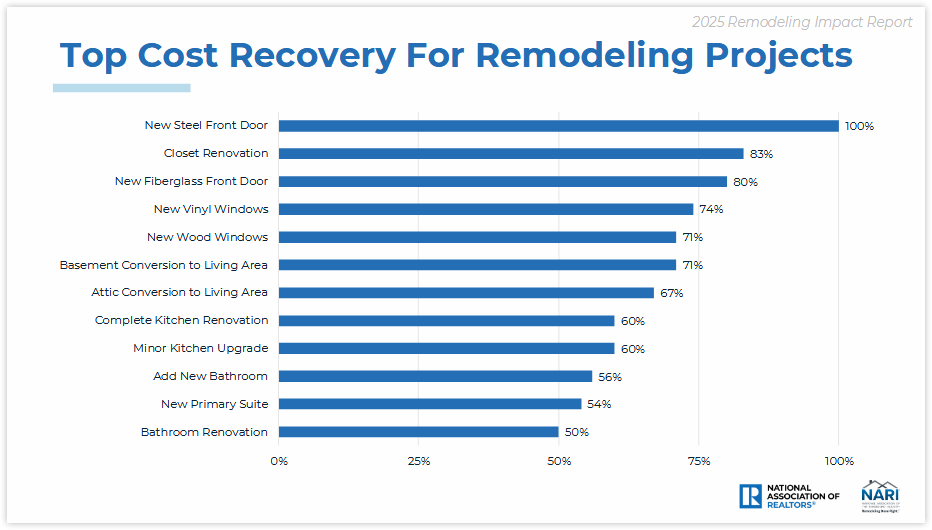

As a bonus to bringing you joy, many projects will also pay you back for at least a portion of their cost when it’s time to sell your home. Projects that increase your home’s curb appeal tend to bring you the highest return on investment (ROI), although closet renovation snuck in as a surprise gem:

What If You’re Remodeling to Sell?

In virtually any real estate market, a home that feels fresh, clean, modern, and move-in ready will always sell faster and for more money than its dated counterpart. This isn’t always tangible in the ROI studies but, as agents, we see it every day. The good news is that the updates you make to sell are often more cosmetic and less expensive than the upgrades you might make if you were planning to stay in the home forever (pssst…check out this article on remodeling projects you should avoid if you’re selling your home).

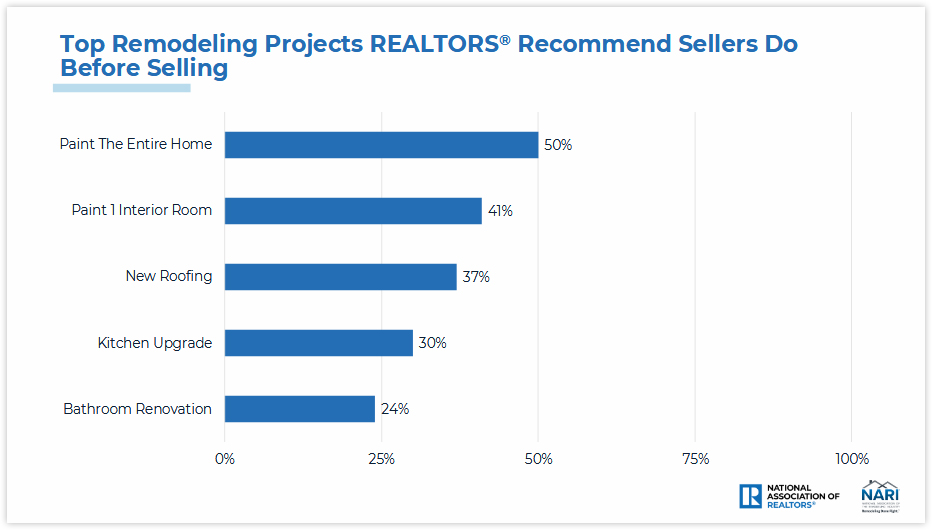

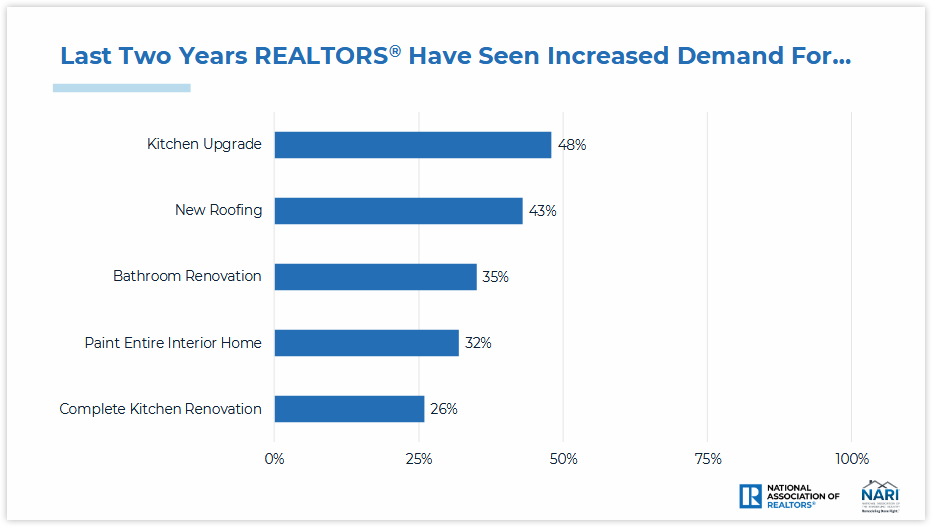

The two charts below show both the projects REALTORS® most often recommend sellers do before selling, and five projects we’ve seen increased demand for from buyers:

It’s critical to understand that every home, neighborhood, and situation is different. Your home’s unique characteristics and your personal goals as a homeowner will have more impact on which remodeling projects are best for you than any of these general trends. If you’re remodeling to sell, reach out for advice; I’m happy to help you choose the right projects—and avoid the wrong ones—to help you accomplish your objectives.

Data & charts copyright ©2025 “2025 Remodeling Impact Report.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. April 9, 2025, https://www.nar.realtor/sites/default/files/2025-04/2025-remodeling-impact-report_04-09-2025.pdf.

© Copyright 2025, Windermere Real Estate/Mercer Island.

How to Price Your Home for Sale

The right listing price is absolutely critical to a successful home sale. Price too high and you will miss your shot to generate interest with a sense of urgency for buyers—often, overpriced listings languish on the market and end up selling for less than they would have if they’d been priced more competitively from the get-go. Price too low, however, and you risk leaving money on the table if your home doesn’t attract multiple offers. So how do you price it right?

As agents, we track market conditions daily to understand where the “Goldilocks zone” lies for different neighborhoods and price points based on buyer demand and competing properties. Your best bet is to work closely with your agent on an effective pricing strategy before listing your home…BUT in the meantime, here’s some info to help you better understand what goes into this process.

- Understanding the Value of Your Home: Market Value vs. Assessed Value and More

- The Difference Between a Comparative Market Analysis and an Appraisal

What’s your home worth?

While nothing can replace an in-person evaluation by a real estate agent or appraiser, automated valuation models (AVMs) can be a helpful first step in determining what your home is worth. AVMs assess your home by comparing its information with the listings in your area. An algorithm can’t possibly know about the unique characteristics of your home or its neighborhood…but it can give you a rough ballpark idea of your home’s value and how it’s changing over time. Curious? Try my Home Worth Estimator here:

What factors influence home prices?

Understanding what factors influence home prices will give you a deeper knowledge of the market, give clarity to the selling process, and help you work with your agent to accurately price your home.

Comparable Home Sales

Comparable home sales—or “comps”—have a major impact on the price of your home. Comps refer to the comparable homes in your area, both pending and sold, within the last six months. I can provide you with a Comparative Market Analysis (CMA) to better determine the price of your home. CMAs factor in aspects such as square footage, age, and lot size compared to other homes in your area, to determine how your home should be priced among the competition. Reach out if you’d like to request one.

Your Home’s Location

Location, location, location. It plays one of the most significant roles in your home’s asking price. Market conditions in your area, whether you reside in a metropolitan, suburban, or rural location, and the home’s proximity to amenities, schools, and entertainment all contribute to the price.

Your Home’s Condition

If you have recently invested in upgrades or other remodeling projects for your home, they could increase your asking price. However, the price increase potential depends on the kind of renovation, its ROI, and how valuable it is to buyers in your area. If the home needs repair, it will likely generate less interest from buyers than better maintained homes at your price point. Any outstanding repairs or projects looming overhead will make the home less attractive to buyers and could lead to a low appraisal.

Seasonality

Any factors that impact market supply and demand are worth taking into consideration when preparing to price your home, and seasonality is one that cannot be overlooked. Typically, market activity slows in the winter and picks up during the spring and summer months. For more in-depth info, check out these articles on The Best Time to Buy or Sell a Home and Timing the Market.

Market Conditions

Finding a competitive listing price will be depend on local conditions, such as whether it’s a buyer’s or seller’s market. Some sellers think that pricing their home over market value means they’ll sell for more money, but the opposite can often be true. Overpricing your home presents various dangers such as sitting on the market too long, which can result in selling for well below what it’s worth.

Periodic Price Adjustments

Pricing a home isn’t a set-it-and-forget-it proposal. As with any strategy, you need to be prepared to adapt to fast-changing market conditions, new competition, a lack of offers, and other outside factors.

These are the basic tenets for understanding what goes into the price of a home. When you’re ready, I can interpret and expand on this information, perform a CMA for your home, and guide you throughout your selling journey.

Adapted from an article originally appeared on the Windermere blog October 5, 2022.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

A Consumer’s Guide to Homeowners Insurance

If you’re a homeowner or looking to buy a home, insuring your property is critical to protecting your investment—and if you’re getting a mortgage, it’s a must. It can be daunting trying to navigate the many options available to you. What does your policy cover…and what isn’t covered? What does the insurance company provide if your property is damaged or destroyed? Recently, the National Association of REALTORS® released this helpful guide on understanding the ins and outs of homeowners insurance. Here is a quick rundown of what you need to know…

How does property insurance work?

For certain unexpected events that cause a loss to your home or property, homeowner’s insurance can cover the cost to repair/rebuild the property and other structures like fences or garages. Most policies also cover personal belongings within the home, legal/medical fees for accidents occurring on the property, and temporary housing if a covered event (like a house fire) makes your home uninhabitable.

What losses are covered?

Your insurance policy will list the specific “perils” that are covered. The most common type of policy covers both the structure and personal assets for losses from house fires, storms, freezing, theft, vandalism, and sudden plumbing bursts—this is known as a HO-3 or “Special Form” policy. Most policies don’t cover earthquakes or natural floods (although you can get additional policies for those perils).

Is insurance required?

There are no laws requiring you to maintain homeowners insurance. However, most lenders require it for the duration of your mortgage. Required or not, it’s generally a good idea to protect your assets (especially if you have a lot of equity in your home).

What is the cost, and how is it paid?

As with many costs, insurance premiums are on the rise throughout the country (here’s how much, where, and why). Your individual policy’s cost will be based on your home’s age, size, condition, location, and other factors like whether you have a security system or have added on additional coverage. You may have the option to pay the premium annually or break it into smaller payments. If you have a mortgage, the lender usually collects a monthly “escrow” payment that they keep in an account to pay the insurance premiums and property taxes from on your behalf.

What happens in the event of a loss?

Most insurers will cover “replacement cost”—the amount needed to buy a new, comparable version of what you lost up to a dollar limit specified in the policy. It’s important to understand that replacement cost is not the same as market value; you’ll be compensated for the actual cost to repair/rebuild/replace your home regardless of what you paid for it or what you could sell it for. Typically the insurer will reimburse you to have your home repaired or replaced with comparable quality if it’s insured to at least 80% of it’s replacement cost, less any deductible that your policy has.

Alternatively, “actual cash value” is the current value of an item that depreciates over time or with use (often used for replacing personal or under-insured property). For example, if you paid $2,000 for your new couch but now it’s only worth $1,000 due to normal wear and tear, your insurer will only pay $1,000 less the deductible. You may choose to upgrade your personal property coverage to replacement cost instead for an extra fee.

For extra peace of mind, you can also purchase an extended replacement cost policy that provides extra coverage up to a set percentage above the policy limit. This can protect you if your home costs more than anticipated to rebuild.

Are the premiums tax deductible?

The short answer is no, unless you run a business from your home or it’s a rental property. However, you may be able to claim a casualty loss deduction if you suffered a loss due to a federally declared disaster (but check in with your tax pro for advice specific to your situation).

Because laws vary from state to state, it’s important to do your homework if you’re purchasing a home in an unfamiliar area. You can either connect with me or your attorney for advice.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

Selling Your Home: 5 Common Myths

Selling your home is a crash course in real estate education. My clients learn a LOT as we work together to find a buyer and sell at the right price. As you prepare to sell, it’s important to remember that that not everything you’ve heard is true. There are several common myths that can lead to costly mistakes in the selling process. Knowing the truth behind them will clarify your selling journey and help you align your expectations…

Myth 1: Home Value Calculators Are 100% Accurate

Online Automated Valuation Models (AVMs) are a great starting point for understanding how much your home could be worth. However, they are merely a first step in determining home value; to say they are 100% accurate is a myth. When it comes to pricing your home, you need to rely on a true Comparative Market Analysis (CMA), which uses vast amounts of historical and current data on real estate listings to arrive at an accurate and competitive figure.

To get an estimate of how much your home is worth, try our Home Worth Calculator here:

Myth 2: Selling FSBO Will Save You Money

Selling a home requires an intimate knowledge of the housing industry and how to solve the complex situations that arise throughout a real estate transaction. Despite this, some sellers will go it alone and attempt to sell their property without being represented by an agent.

Selling For Sale by Owner (FSBO) is a risky proposition. It requires the seller to bear added liability, fills their schedule with various marketing and promotional responsibilities, and can leave money on the table by inaccurately pricing the property, causing it to sit on the market for too long. The potential costs of selling a home on your own far outweigh the commission real estate agents earn on a home sale.

Myth 3: You Must Remodel to Sell Your Home

The question you’ll face when preparing to sell your home is whether to sell as is or remodel. The answer usually lies somewhere in between, but it depends on your situation and what kinds of home upgrades are driving buyer interest locally. When making improvements to your home, lean toward high ROI remodeling projects to get the best bang for your buck, and avoid trendy projects that can delay listing your home. If you’re considering major upscale renovations, talk to me about which projects buyers in your area are looking for.

Myth 4: Never Accept the First Offer

You’ve likely heard tell that the first buyer’s offer is nothing more than a springboard to up your asking price and to never accept it. In this case, “never” should be approached with caution. In reality, the best offer for your home is one that you and your listing agent have discussed that aligns with your goals. If a matching offer happens to be the first one that comes your way, so be it. The market can shift at any time, so you never know what may happen if you leave an offer on the table. And if the buyer backs out of the deal, you and your agent will find a path forward.

Myth 5: Home Staging Doesn’t Make a Big Difference

Staging your home is so much more than a cosmetic touch-up; it has been proven to help sell homes faster and at a higher price than non-staged homes.1 Staging ensures that your home has universal appeal, which attracts the widest possible pool of potential buyers. When buyers are able to easily imagine living in your home, they become more connected to the property. You should stage your home regardless of your local market conditions, but it can be especially helpful in competitive markets with limited inventory where even the slightest edge can make all the difference for sellers.

Now that you know some of the most common myths in the selling process, get to know its truths. Connect with me to get the process started:

1: National Association of REALTORS® – Why Home Staging Inspires the Best Prices in Any Housing Market

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere Blog, written by: Sandy Dodge.

Remodeling Projects to Avoid When Selling Your Home

It’s common for homeowners to feel compelled to remodel their homes before they sell. Renovating the spaces in your home can increase its value and help you compete with comparable listings in your area. However, some remodeling projects are more beneficial than others as you get ready to hit the market. Always talk to myself or another local agent to determine which projects are most appealing to buyers in your area.

When preparing to sell your home, you want to strike the right balance of upgrades. Making repairs and executing renovations will attract buyer interest, but you don’t want to dump so much cash into remodeling that you won’t be able to recoup those expenses when your home sells.

So, how do you know where to focus your efforts? Your agent is a vital resource in understanding your specific situation—I typically offer guidance to my clients on remodeling efforts that will help sell their home for the best price. Here are a few projects sellers will want to keep off their to-do lists for the best return on investment…

Major, Pricey Upgrades with Long Timelines

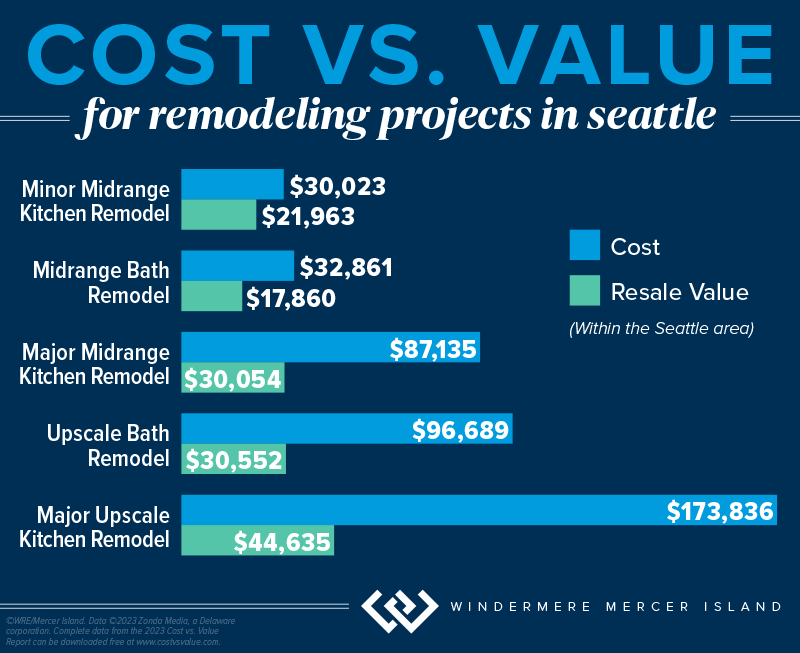

For any remodeling project, an analysis of your home’s value will be key to helping you determine its risk/reward potential (reach out if you’d like one for your home). This dynamic is especially important for big remodels and home upgrades, due to their higher costs. The latest Remodeling Cost vs. Value Report (www.costvsvalue.com)1 data for the Seattle area shows a generally negative return on investment for major, upscale remodeling projects—they only recouped about 25%-30% of their cost…

These projects come with hefty price tags and longer timelines than minor repairs and upgrades, which can complicate factors as you prepare to sell, especially if you have a deadline to get into your new home. They have the potential to temporarily displace you from the property, meaning you and your household may have to find somewhere else to stay until the project is complete.

The Bottom Line: To go through with a major home upgrade before you sell, its schedule must fit with your moving timeline. It should also align with buyer interest in your local market. If the project doesn’t meet these criteria, it should be avoided.

Non-Permitted Projects & Building Code Violations

Before you decide to finish out the basement or make changes to your home’s wiring/structure/mechanical systems, it is important to make sure you obtain the proper city, county and/or state permits + inspections. Non-permitted square footage does not reflect on the county tax record and can lead to low appraisals when the buyer tries to get a loan. Obtaining permits also helps ensure your alterations meet the current building code—otherwise, you may face legal exposure should they create a safety hazard. Furthermore, any non-permitted remodels must be disclosed to the buyer on your Form 17 if you live in Washington State. The buyer’s mortgage lender may also have stipulations saying that the loan may not be used to purchase a home with certain features that aren’t up to code, which could lead to them backing out of the deal.

If you’re selling an older home, you’re not obligated to update every feature that may be out of code to fit modern standards. These projects are often structural and require a significant investment. If the violation in question was built to code according to the regulations at the time, then a grandfather clause typically applies. However, you’ll need to disclose these features to the buyer.

Trendy Makeovers and Upgrades

Lastly, it’s best to avoid remodeling projects that target a specific trend in home design. Trends come and go. Timeless design is a hallmark of marketable homes because it appeals to the widest possible pool of buyers. Keep this in mind when staging your home as well. Creating an environment that’s universally appealing and depersonalized allows buyers to more easily imagine the home as their own.

Wondering which remodeling projects might help your home sell? Reach out any time…I’m never too busy to discuss your options and offer advice based on the current market.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

1©2023 Zonda Media, a Delaware corporation. Complete data from the 2023 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

Adapted from an article that originally appeared on the Windermere Blog, written by: Sandy Dodge.

To Sell or to Rent? The Perks and Pitfalls of Being a Landlord

Analyzing whether to sell or rent your home is a BIG deal…and it deserves careful consideration. Ultimately, the right choice for you depends on your financial situation, goals, and personal preferences. Here is a quick run-down to help you decide:

Renting Out Your Home Might Make Sense If…

- You don’t need the funds from your current home to purchase another home

- You’re moving temporarily and planning to return to the area

- You think your home’s value will drastically increase within the next few years

- The rental market is especially hot in your area

- You have the time and know-how to screen tenants, manage rent/collections, and make home repairs (or would have enough cash flow to pay for third-party management)

- Rental income is part of your long-term investment strategy

Selling Your Home Might Make Sense If…

- You need to use the equity from your current home to purchase another home

- Rent wouldn’t generate enough cash flow to cover things like vacancies, maintenance, repairs, and landlord insurance in addition to the existing mortgage, taxes, and HOA dues

- You don’t want to take on the risks, time commitment, and challenges of being a landlord

- You’re uncomfortable with the landlord-tenant laws in your area

- A home sale would generate a large profit (and has been your primary residence for at least 2 out of the last 5 years so that you’re eligible for capital gains tax exemptions)

- You’re concerned a future recession might negatively impact your finances

Before reaching a conclusion, it’s a good idea to familiarize yourself with the landlord-tenant-law specific to your state (and in some cases, separate relevant ordinances in the city and/or county that your property lies within). You should also do some market research to get a feel for price/condition of similar homes for rent and for sale in your neighborhood.

It probably makes sense to talk with a property management professional to clearly understand what you can expect to net as a landlord. You can also reach out to me any time for an accurate estimate of your home’s value should you decide to sell.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2023, Windermere Real Estate / Mercer Island.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link